nj tax sale certificate premium

Electronic Municipal Tax Sales Online LFN 2018-08 Adoption of NJAC 533-11 creating regulations for long standing PILOT program for internet-based tax sales. As a statutory officer of the State of New Jersey the tax collector is obligated to follow all state statutes regarding property tax collection including billing due.

Tax Lien Calendar Buy Tax Liens Online Property Tax Liens On Unique Exchange

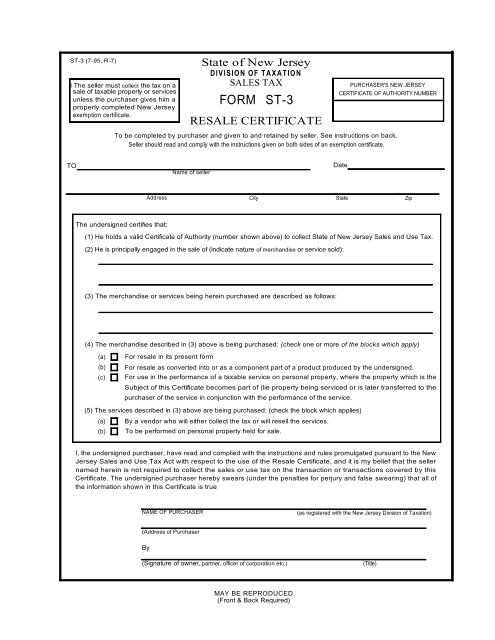

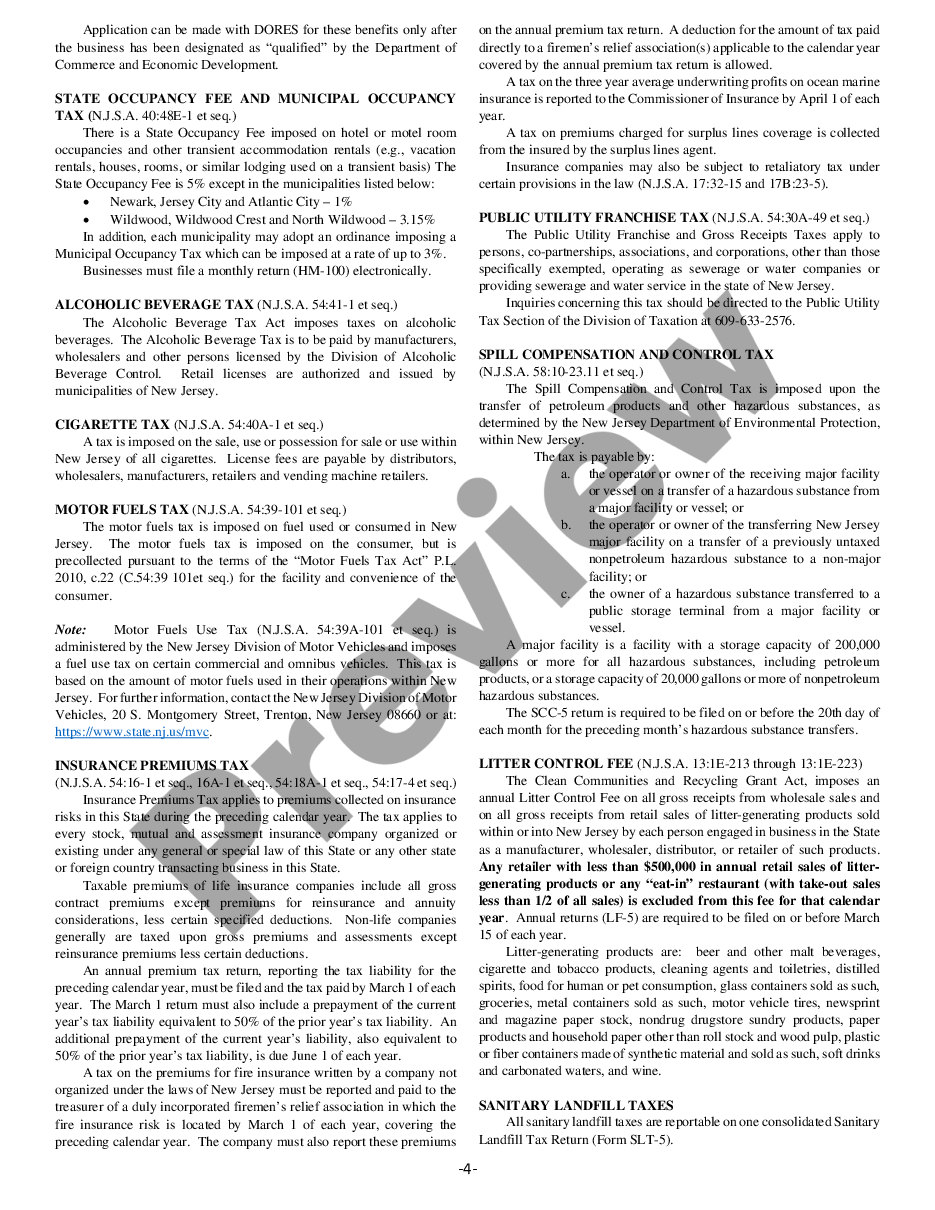

Sales and Use Tax.

. New Jersey is a good state for tax lien certificate sales. In order to redeem the lien the property owner must pay the certificate amount plus the redemption penalty and the subsequent tax amount at 24. 2016 and prior.

Thats 5000 lien amount 200. The standard tax sale is held within the current year for delinquent taxes of the prior year. VINTAGE TREASURES IN HILLSBOROUGH NJ Thu Apr 28 2022 at 705 PM EDT Hillsborough New Jersey Buyers Premium.

New Jersey Tax Certificate Process Please note. Here is a summary of information for tax sales in New Jersey. Sales and Use Tax.

Select A Year. Nj tax sale certificate premium. 18 or more depending on penalties.

Discretion of tax collector as to sale. The seller must collect the tax on a sale of taxable property or services unless the purchaser gives them a fully completed New Jersey exemption. Purchasing a tax sale certificate is a form of investment.

New Jersey assesses a 6625 Sales Tax on sales of most tangible personal property. Purchasing a tax sale certificate is a form of investment. Here is a summary of information for tax sales in New Jersey.

Contracts considered professional service. About Annual Tax Sales. The procedures that govern tax foreclosure are set down in the Tax Sale Law NJSA.

New Jersey Sales and Use Tax Energy Return. 30 rows Sales and Use Tax. Nj tax sale certificate premium.

Sign Purchases and Installation Services Sales and Use Tax Effective October 1 2022. As with any governmental activity involving property rights the process is not simple. If the interest is bid down to 1 a premium is bid up until the bidding stops to obtain the tax sale certificate.

A Will drawn in another state can be valid. Sales and Use Tax. According to New Jersey Law on tax lien certificate greater than 200 a penalty of 2 is added to the tax lien certificate tax lien certificates greater than 5000 bring a 4 penalty and tax.

There are 2 types of tax sales in New Jersey. Lands listed for sale.

The Essential List Of Tax Lien Certificate States

New Jersey Tax Liens Premier Tax Liens

Tax Liens Course Tax Liens Unleashed

Revision To The Tax Sale Law Tragedy For Distressed Homeowners New Jersey Law Journal

Are You Bidding Premium For Tax Liens Tax Lien Investing Tips

How To Buy Tax Liens In New Jersey With Pictures Wikihow

How To Buy Tax Liens In New Jersey With Pictures Wikihow

Planning For Medicare Taxes Premiums And Surcharges Journal Of Accountancy

New Jersey Certificate Of Formation For Domestic Limited Liability Company Llc Certificate Of Formation Nj Sample Us Legal Forms

New Jersey Tax Sales Explained Tax Liens Tax Deeds A Goldmine For Real Estate Investors Youtube

Keeping Your Home After A Nj Tax Foreclosure Sale

How To Buy Tax Liens In New Jersey With Pictures Wikihow

The Essential List Of Tax Lien Certificate States

New Jersey 2021 Tax Lien Sale Deal Of The Week Youtube

The Essential List Of Tax Lien Certificate States

Revision To The Tax Sale Law Tragedy For Distressed Homeowners New Jersey Law Journal